News

OCCU Team Leverages Corporate Volunteer Benefits to Maintain Oregon Nature Preserve

OCCU’s organizational development team volunteered at the Howard Buford Recreation Area outside Eugene.

Horizon Credit Union Nearly Triples Donation to Support Affordable Housing

The credit union presented a $12,192 donation to NeighborWorks Boise.

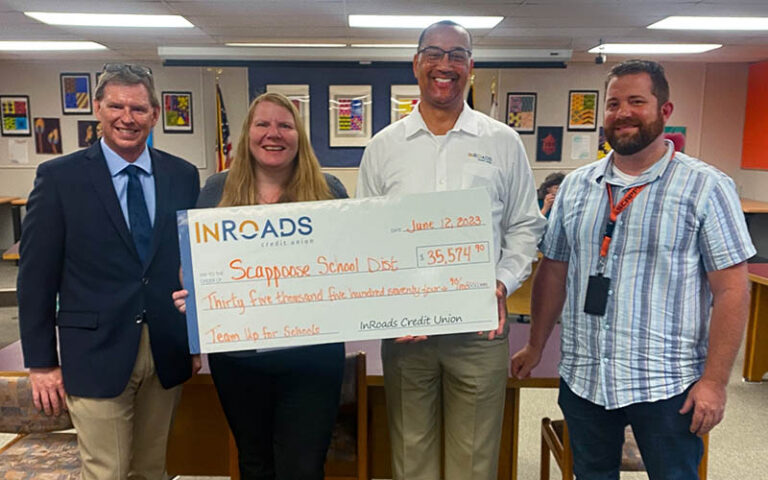

InRoads Program Raises Over $431,000 for Local Schools

The program encourages members to use a special, co-branded debit card featuring one of three high school mascots.

First Tech Federal Credit Union Awards Over $1 Million in Education Grants to 69 West Coast Nonprofits

The awarded organizations facilitate equitable access to science, technology, engineering, math (STEM), early childhood literacy, and financial education.

GoWest Spring Hike a Success

Over 20 credit union leaders and GoWest staff traveled to Washington, D.C. for "Hike the Hill."

How GoWest is Helping CU Professionals on Their Journey to Executive Leadership

Follow the journey of your peers as they experience GoWest's leadership development programs.

Oregon Bill Requiring Financial Literacy for High Schoolers Passes House and Senate

Once implemented, students will earn ½ credit on each of two tracks — one teaching higher education and career skills and the other offering personal financial education.

Forbes Announces ‘Best Credit Unions in Each State 2023’

Several GoWest credit unions within the six-state region were recognized.

More Than a Score: Using AI to Empower Members Across the Credit Spectrum

AI-automated underwriting makes it possible to accurately and fairly assess thin-file members — or most everyone else, for that matter.

First Tech Federal Credit Union ‘Putts’ for Medical Miracles at CU4Kids NW Classic

The event will be held July 10 in Aloha, Oregon.

Elevations Credit Union Wins Diversity, Equity, and Inclusion Award

The not-for-profit credit union is the only organization in Colorado to be recognized two years in a row by the Denver Business Journal.

Maps Community Foundation Awards 2023 Scholarships

24 Oregon high school seniors received support to further their educational dreams.

Columbia Credit Union Donates $10,394 to the American Heart Association

The funds were raised by Columbia CU’s staff during an internal campaign to support research fighting heart disease.

Compliance Newsletter – June 27, 2023

Stay informed on the latest news and resources around compliance-related issues.

OnPoint Community Credit Union Releases Free E-book on How to Build Credit

'Guide to Credit Reports and Scores' provides guidance on understanding, improving, and protecting credit.

MAXX 2023: Scholarships Available for the Signature Conference of the Year

It's bigger and better than ever! With scholarships, it's easier than ever to join the MAXX experience.

Charting A Path to Change Through Advocacy 101 and 201

Anyone can be an advocate — the only thing you need to do is share your story.

First Tech Federal Credit Union Partners with Youth Villages Oregon to Provide Financial Resources for Foster Youth

Building pathways for underserved youth to achieve financial wellness in Oregon and Southwest Washington.

Horizon Credit Union Raises Nearly $20k for CU4Kids Campaign

CU4Kids is a nonprofit collaboration of credit unions working together in fundraising activities to benefit 170 Children's Miracle Network Hospitals (CMN) nationwide.

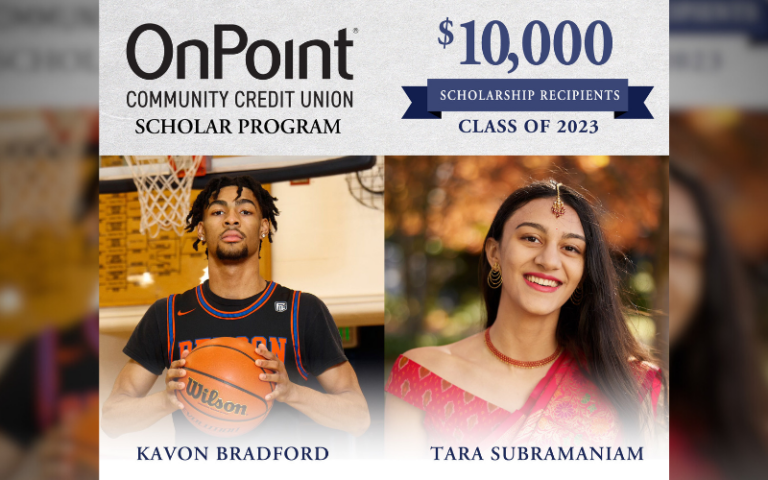

OnPoint Community Credit Union Awards Scholarships to Six Phenomenal OSAA Students

Since 2018, OSAA and OnPoint have partnered to award $90,500 to 25 students.

Compliance Newsletter – June 20, 2023

Stay informed on the latest news and resources around compliance-related issues.