GoWest Solutions

Embedded Lending Will Be Key to Credit Union Loan Growth in 2025

Today’s loan-growth leaders in the credit union industry share a common proficiency—digital integration. New research from TruStageTM, Making Strategic Choices for Growth, reveals the strategic decisions behind the success of top-performing credit unions.

Digital Trends: Removing Friction in the Member Experience

Digital banking has forever changed consumer expectations, and it’s changed how credit unions need to respond. The good news is that technology can support a better, more convenient member experience — and, at the same time, help financial institutions save on costs as they reallocate funds from branches to tech development.

Navigating Distressed & Problem Loans: Legal & Borrower Considerations

By Jason Alpert, Managing Partner of Castlebar Holdings Problem loans are a natural outcome of the risks banks and credit unions […]

The Halloween Effect: How Interest Rate Cuts Impact Credit Union Assets and Liabilities

The recent slashes to interest rates have brought significant changes for credit unions, especially with regard to their assets and liabilities. Take a closer look at how these changes could potentially haunt or help your institution.

Preparing for Event Response: The Importance of Conducting “Tabletop Exercises”

Your credit union should run periodic tabletop exercises, where credit union executives and other team members review how the credit union would respond in the event of a cyber-attack, natural disaster, terrorist attack or other continuity event.

Mitigating Loan Delinquencies, Protecting Members, and Strengthening Credit Union Resilience with Embedded Payment Protection Insurance

By Danielle Sesko, Director of Product Management at TruStage™ In today’s continually challenging economic landscape, more and more credit unions […]

Velera Partners with Kinective to Accelerate Innovation and Time-to-Market for Financial Software Products

Velera, a leading credit union service organization and an integrated financial technology solutions provider, has entered into a strategic partnership with Kinective, a trailblazer in digital connectivity, document workflow and branch automation for the banking sector.

Origence and Catalyst Bring Faster Payments to Credit Union Indirect Lending

Origence, the leading lending technology solutions provider for credit unions, has partnered with Catalyst to deliver enhanced payment capabilities through the FedNow® Service.

Give Them What They Want: How Digital Connections Boost Member Engagement

Increasingly, peer-to-peer (P2P) payments is becoming the go-to choice for consumers. In fact, more than 8 in 10 consumers in virtually all segments utilize P2P, which is enjoying double-digit growth year over year. From 2021 to 2022, the number of consumers using three or more digital wallets increased 12%, according to a report from McKinsey.

Top 10 Financial Influencers Credit Unions Should Be Following

Kate Randazzo of Abrigo, a leading technology provider of compliance, credit risk, lending, and asset/liability management solutions, shared 10 social media accounts that credit unions should follow to gain inspiration for their programs. These financial influencers discuss current events, strategic and policy issues, ethical AI integrations, strategies for competition, and more.

Near- and Non-Prime Consumers Continue to Face Barriers in the New and Used Vehicle Markets

Although the automotive market shows signs of stabilizing, near- and non-prime consumers remain challenged in the used vehicle market. Lenders must be equipped to serve them.

Harnessing AI and EI to Boost Credit Union Efficiency and Member Experiences

Credit unions, like people, have varying strengths in different kinds of intelligences. Traditionally, the credit union creed of people helping people gave the industry strong roots in Emotional Intelligence (EI). With modern applications of Artificial Intelligence (AI) strengthening service and efficiency, there is a lot to be gained

AI for Growth: Unleashing Data to Personalize, Predict, and Profit

AI is a game-changer, and its transformational impact on the banking sector cannot be overstated. A session presented by Claritas Chief AI Officer Rex Briggs at the 2024 Financial Brand Forum will demystify the intricacies of AI, as you explore the groundbreaking technologies and latest innovations in artificial intelligence that are completely reshaping the future of banking.

Origence Announces New Associate Board Members

Origence, the leading lending technology solutions provider for credit unions, announced the appointment of three new associate Board of Directors […]

MAXX 2024 Trade Show: Innovation, Connection, Transformation

More than 150 exhibitors and sponsors will be on hand at the MAXX 2024 Solutions Trade Show – a one-stop shop for credit union professionals to learn about the latest in cutting-edge services and partnerships.

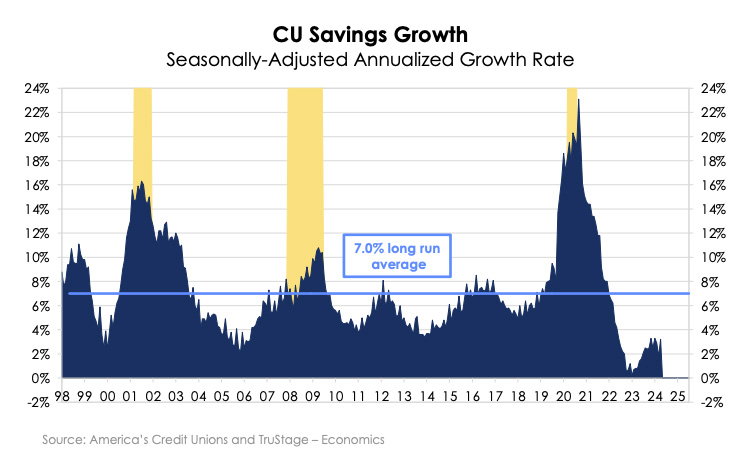

TruStage Releases Credit Union Trends Report

TruStage recently released its June Credit Union Trends Report which shares trends of lending volume and credit quality. Check out highlights of this month’s report.

2024 U.S. Economic Outlook and Its Impact on Credit Unions

Recent economic and market data tells us 2024 will bring slow but steady economic growth and possible interest rate reductions. The Fed will continue to battle inflation with a balanced approach to interest rates in hopes of staving off a recession and bringing inflation rates to an acceptable standard.

How Many Members Can You Afford to Lose?

As new financial technologies emerge and go mainstream, higher consumer expectations will emerge as well. I often think back to the rise of online banking. At one point, that was a nice-to-have convenience. Now, it’s widely considered a non-negotiable service. So, what technology of today is a nice-to-have now, yet likely a must-have later?

How Fintech Collaboration Can Be a Strategy for Success

One third of credit unions see fintech firms as their primary market competitor. Indeed, the innovative, digital nature of fintechs has helped them keep pace with changing consumer demands and provide convenient financial services people want.

TruStage™ Makes GAP Coverage Available Through the Digital Storefront Software as a Service (SaaS) Solution

Financial institutions that use the cloud version of Digital Storefront from TruStage can now offer consumers a new product — GAP. TruStage GAP coverage is designed to help eliminate the difference between how much a vehicle is worth and how much a consumer owes in the event the vehicle is totaled or stolen and not recovered.

Automotive Lenders Are Overlooking the Value of Alternative Data and Instant Decisioning

Open Lending Corporation, an industry trailblazer in automotive lending enablement and risk analytics solutions for financial institutions, released on May 23 its second annual Lending Enablement Benchmark Report.