GoWest Solutions

Near- and Non-Prime Consumers Continue to Face Barriers in the New and Used Vehicle Markets

Although the automotive market shows signs of stabilizing, near- and non-prime consumers remain challenged in the used vehicle market. Lenders must be equipped to serve them.

Harnessing AI and EI to Boost Credit Union Efficiency and Member Experiences

Credit unions, like people, have varying strengths in different kinds of intelligences. Traditionally, the credit union creed of people helping people gave the industry strong roots in Emotional Intelligence (EI). With modern applications of Artificial Intelligence (AI) strengthening service and efficiency, there is a lot to be gained

AI for Growth: Unleashing Data to Personalize, Predict, and Profit

AI is a game-changer, and its transformational impact on the banking sector cannot be overstated. A session presented by Claritas Chief AI Officer Rex Briggs at the 2024 Financial Brand Forum will demystify the intricacies of AI, as you explore the groundbreaking technologies and latest innovations in artificial intelligence that are completely reshaping the future of banking.

Origence Announces New Associate Board Members

Origence, the leading lending technology solutions provider for credit unions, announced the appointment of three new associate Board of Directors […]

MAXX 2024 Trade Show: Innovation, Connection, Transformation

More than 150 exhibitors and sponsors will be on hand at the MAXX 2024 Solutions Trade Show – a one-stop shop for credit union professionals to learn about the latest in cutting-edge services and partnerships.

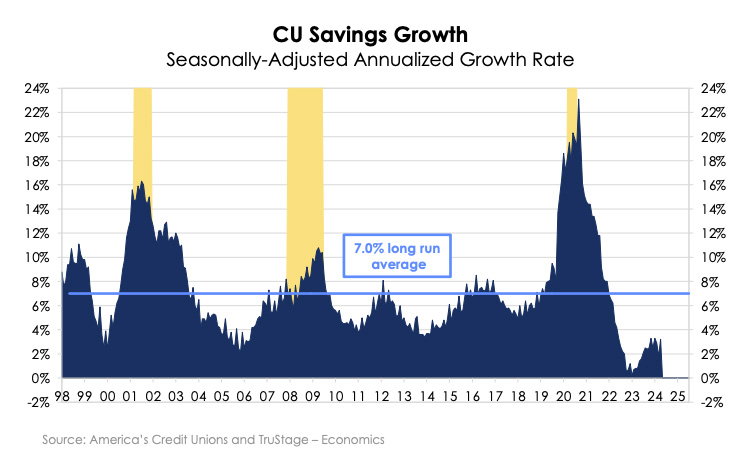

TruStage Releases Credit Union Trends Report

TruStage recently released its June Credit Union Trends Report which shares trends of lending volume and credit quality. Check out highlights of this month’s report.

2024 U.S. Economic Outlook and Its Impact on Credit Unions

Recent economic and market data tells us 2024 will bring slow but steady economic growth and possible interest rate reductions. The Fed will continue to battle inflation with a balanced approach to interest rates in hopes of staving off a recession and bringing inflation rates to an acceptable standard.

How Many Members Can You Afford to Lose?

As new financial technologies emerge and go mainstream, higher consumer expectations will emerge as well. I often think back to the rise of online banking. At one point, that was a nice-to-have convenience. Now, it’s widely considered a non-negotiable service. So, what technology of today is a nice-to-have now, yet likely a must-have later?

How Fintech Collaboration Can Be a Strategy for Success

One third of credit unions see fintech firms as their primary market competitor. Indeed, the innovative, digital nature of fintechs has helped them keep pace with changing consumer demands and provide convenient financial services people want.

TruStage™ Makes GAP Coverage Available Through the Digital Storefront Software as a Service (SaaS) Solution

Financial institutions that use the cloud version of Digital Storefront from TruStage can now offer consumers a new product — GAP. TruStage GAP coverage is designed to help eliminate the difference between how much a vehicle is worth and how much a consumer owes in the event the vehicle is totaled or stolen and not recovered.

Automotive Lenders Are Overlooking the Value of Alternative Data and Instant Decisioning

Open Lending Corporation, an industry trailblazer in automotive lending enablement and risk analytics solutions for financial institutions, released on May 23 its second annual Lending Enablement Benchmark Report.

How Agile Is Your Credit Union’s Compensation Strategy?

The legacy organizations that are thriving in the Experience Age are those that have mastered strategic pivots. From reengineering conventional products to reconfiguring entire business models, the changes these winners are making are all in the name of relevancy with stakeholders.

Origence Celebrates 30th Anniversary with Fundraiser Supporting Children’s Miracle Network

Origence’s “30 Years of Impact” fundraiser will match donations made under the campaign at Lending Tech Live ‘24.

ATM Crime and Best Practices for Prevention

Skimming, vandalism, and physical attacks on ATMs, armored car and cash-in-transit (CIT) personnel, ATM technicians, and other ATM crimes are all on the rise throughout the U.S.

GoWest Solutions Announces Executives@Skamania Scholarship Winner Kendra Galloway

GoWest Solutions is pleased to announce the scholarship winner to the 2024 Executives@Skamania: Kendra Galloway, VP, Process & Partner Innovation, Climb Credit Union.

How Financial Institutions Can Craft Compelling Content on Social Media

Social media reigns supreme these days, which means financial institutions have with a unique opportunity to engage with their audience where they spend most of their time – online. However, many institutions are daunted by the task of creating meaningful content that not only resonates with their audience but also complies with regulatory standards.

The Impact of Rising Debit Card Fraud and How to Defend Against It

Taking a closer look at the trending tactics for collecting card information and using it for fraud attacks can help credit unions take more effective, proactive steps to guard against it.

GoWest Solutions Announces Advanced Leadership Program Scholarship Winner Neda Milani

GoWest Solutions announces the scholarship winner to the 2024 Advanced Leadership Program: Neda Milani, Lending/Collections Manager, Credit Union of the Rockies.

Five Steps Credit Unions Can Take to Find the Right Fintechs Today

Fintechs have disrupted the status quo by offering streamlined digital solutions that challenge traditional banking models, empowering individuals and businesses with greater control over their finances and democratizing access to financial services.

GoWest Extends TruStage Partnership with Clutch’s Fintech Platform

GoWest Solutions has expanded its long-standing partnership with TruStage through a new relationship with Clutch, a leading fintech platform specializing in omnichannel consumer loan and deposit account opening solutions for credit unions.

Unveiling the Power of BI: Credit Unions Invited to Gain Insight May 16 in Denver

Whether you’re just getting started or you’re fine-tuning your BI strategy, Denver-area credit unions are invited to join GoWest and Trellance on May 16 for one of two in-person training sessions being offered.