Fall Hike the Hill: A Productive Week for GoWest Credit Unions

September 27, 2024

The 2024 elections and Congressional actions dominated the news cycle this week. The flurry of activity didn’t deter advocates from the GoWest region. What better time than a busy time to show up for Fall Hike the Hill and talk about issues policymakers like to discuss?

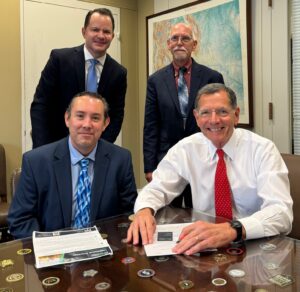

Twenty passionate advocates from all six GoWest states joined our team, fanning out across 39 Congressional offices to share news of credit unions’ positive impact, and services to the constituents those officials are elected to represent.

“Amid all the election news and finalizing a continuing resolution to keep the government running until mid-December, Congress welcomed the opportunity to learn more about credit unions’ priorities and continuing work in local communities,” said Ryan Fitzgerald, SVP, Advocacy. “And we already had commitments from the region’s representatives to co-sponsor credit union related legislation, and to actively oppose efforts to re-balance the Electronic funds Transfer Act.” Having credit union thought leaders to reinforce priority messaging was timely, Fitzgerald noted.

GoWest was also able to arrange meetings for our advocates with two significant regulatory meetings during the Fall Hike– the Federal Housing Finance Agency, and the Federal Reserve.

At FHFA, we had a positive dialogue with Deputy Director Josh Stallings and Principal Policy Advisory Rebecca Cohen regarding the core mission, affordable housing set aside, and access to the FHLB. Credit unions advocated for an incremental approach to modernization of FHLB—an institution that for 90 years has provided liquidity to financial institutions to support the housing market.

Areas of focus included allowing credit unions to be designated as a Community Financial Institutions, a designation that currently only applies to FDIC-insured banks and we are pleased to report, the FHFA supports expanding the designation to include credit unions. Benefits of the designation include lower cost of borrowing, additional collateral that can be pledged to secure borrowings, and an exemption from the housing threshold requirements.

During the meeting at the Federal Reserve, credit union leaders effectively conveyed that a one-size-fits-all approach to interchange is contrary to Congressional intent and conflicts with the statute. Our advocates strongly recommended a tiered approach that would ensure $10 billion-dollar financial institutions are receiving more per swipe transaction than a $3.5 trillion-dollar bank which has much lower transaction costs and should be reimbursed less. Other items discussed included potential changes to excess share balances held by the Fed and a motor dealer vehicle rule, both of which could have impacts on credit unions.

The opportunity to meet in person with two such critically important regulatory agencies was a testament to how they value credit union input, according to John Trull, GoWest’s VP, Regulatory Advocacy. He stated that “both meetings were highly productive, and credit union leaders came well-prepared, ensuring their key concerns were heard and understood.”

Posted in Advocacy on the Move, Federal Advocacy, Regulatory Advocacy.