GoWest Solutions

Eltropy Launches Industry’s First Agentic AI Platform for Credit Unions

Eltropy launched the industry’s first Agentic AI platform for credit unions, which provides a safe environment where AI agents can be created, governed, integrated, and deployed.

GoWest Solutions Welcomes Casap as Partner for Agentic Dispute & Fraud Automation

GoWest Solutions is pleased to announce a new partnership with Casap, an agentic AI platform purpose-built to take the complexity out of dispute and fraud operations.

What 2026 Economic Trends Mean for Credit Union Strategies

Economic signals suggest 2026 will not be a repeat of the last decade’s boom times, but it won’t be a disaster either.

Loan Growth Strategies for Credit Unions That Drive Results

By leaning into bold, data-driven strategies and future-focused marketing, financial institutions can turn this surge in demand into long-term growth — helping members feel understood, valued and connected to your brand.

2026 Forecast: Big Ideas and Bold Innovations Ahead

By Velera The banking and payments landscape in 2026 will likely be shaped by transformative innovations and driven by changing consumer […]

How Financial Institutions Can Stay Ahead of Rising ACH Fraud

Credit unions need to recognize ACH fraud risks early and ensure that appropriate controls, staffing, and technology are in place to mitigate them.

Swipe, Tap, Repeat: How Gen Z Is Driving Payments Innovation

Released annually since 2018, Velera’s 2025 Eye on Payments study gauges the current state of payment preferences among credit union members and other financial institution customers, while exploring the factors that influence these trends

The Rise of ATM “Jackpotting”: How to Protect Your Credit Union & Members

“Jackpotting” involves tricking ATMs into spitting out the cash inside. While it doesn’t directly affect members, it can result in a huge loss for credit unions.

Micro‑Engagements: Turning Digital Moments Into Member Momentum

By Sarah Martin, CEO, Pulsate Credit unions already own the relationship advantage. The opportunity is to make that advantage tangible […]

Unlocking Member Loyalty & Operational Excellence Through Transaction Enrichment

In today’s data-driven financial landscape, transaction enrichment isn’t just about cleaning up chaos — it’s about transforming raw data into actionable insights that deepen member relationships and drive growth.

Cybersecurity in Credit Unions: A Shared Responsibility for a Trusted Future

As cyber threats grow more sophisticated and regulations become more complex, credit unions must evolve their approach to cybersecurity and be vigilant in monitoring for threats.

Trailhead Credit Union Partners With Catalyst for New Payments Solutions

Catalyst announced its latest strategic partnership with Trailhead Credit Union to deliver instant and real-time payments and Catalyst’s advanced peer-to-peer (P2P) payment solution to Trailhead members.

AI-Driven Elder Fraud: Deepfakes; The Newest Threat

AI-driven elder fraud involves scams that use artificial intelligence to make attacks against older adults more convincing, harder to detect, and easier to carry out on a large scale.

Rethinking Digital Strategy: Designing for Growth

By Origence Digital convenience has become the new standard. From ordering dinner with a swipe to managing investments through intuitive […]

Faster Payments, Faster Criminals: Guarding Against Cybercrime in an Instant Payments World

Real-time payment systems and money transfer apps are making the movement of money quicker and easier than ever before – but their speed, finality and always-on availability are proving to be extremely attractive to scammers.

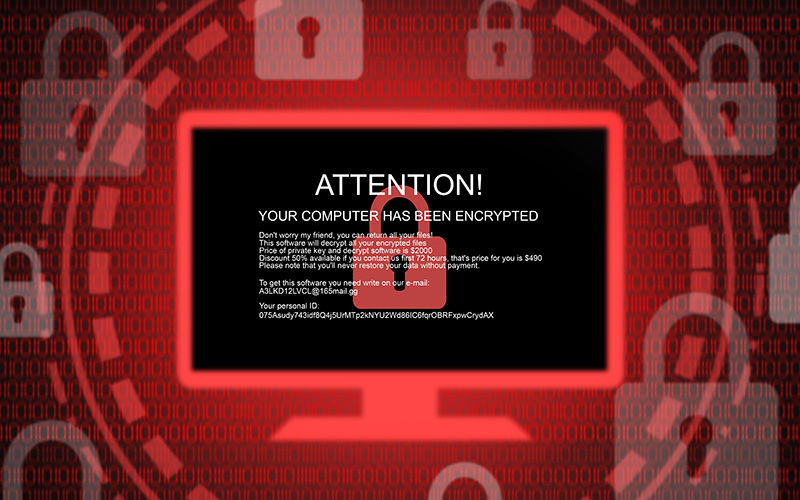

The Ransomware Readiness Gap: Why Practice Makes All the Difference

The credit unions that have run a ransomware tabletop exercise with our team have learned one key truth: you can’t know how ready you are until you put your plan to the test.

Modernizing Secure Access for Financial Institutions – Why SASE and ZTNA Are Imperative in a Perimeterless World

For IT and security executives at banks and credit unions, this evolution presents a challenge and an opportunity: how to secure sensitive operations in a world where users, devices and data operate far beyond the corporate firewall.

Tokenized Deposits vs. Credit Union–Backed Stablecoins: What’s the Real Difference?

The two sound similar on the surface, but the intent and impact behind them are very different.

Artificial Intelligence – A Risk Overview

By TruStage As we witness significant growth in the use of artificial intelligence (AI) technologies, it’s essential to consider the […]

GoWest Solutions Partners with Mastercard to Empower Credit Unions Through Innovation, Security, and Strategic Engagement

GoWest Solutions has announced a strategic partnership with Mastercard, a global technology leader in the payments industry, to deliver next-generation payment solutions, cybersecurity tools, and real-time data capabilities to credit union.

Credit Unions Bet on Stablecoins to Keep Members…and Liquidity

The point isn’t to turn community institutions into crypto startups. It’s to make digital asset capabilities feel like just another account type or collateral class in the core system.