Inslee Budget Proposal Invests in Public Health

Posted by Ben Shuey on December 17, 2020

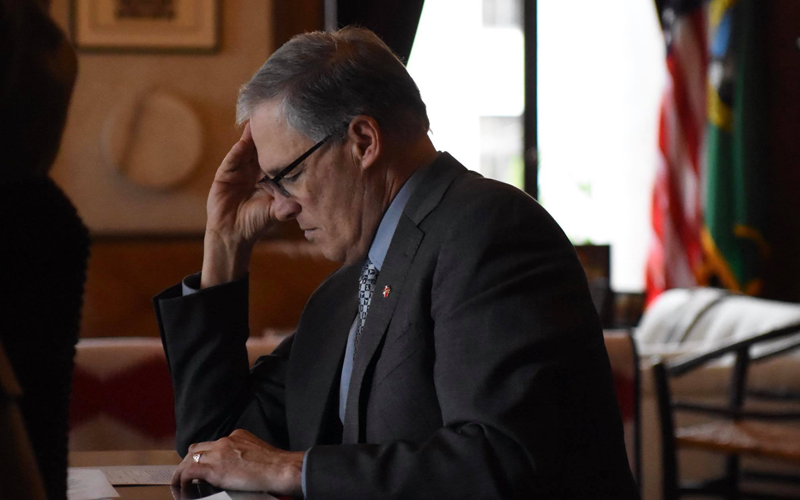

As is both tradition and a requirement under state law Governor Jay Inslee today unveiled his office’s budget proposals as a roadmap for lawmakers to consider during the upcoming legislative session as they work to craft new two-year operating, capital, and transportation budgets. While lawmakers will develop their own proposals independently, the governor’s budget lays out the executive branch’s priorities throughout all of state government operations and incorporates requests from state agencies.

Inslee proposed a $57.9 billion state operating budget for the 2021-23 cycle that pays for daily operations of state government including public education, health care, social services, and much more. Major investments are called for in public health, economic supports for people facing financial challenges including rental and small-business assistance, and to maintain previously identified investments in education, child care, and in addressing climate change.

The plan would achieve this through recovering state tax revenues that still project to increase between 3 and 4 percent annually over the next five years as well as the use of the state’s emergency reserves. Inslee also calls for the Legislature to institute a 9% tax on capital gains on the sale of stocks, bonds, and other assets, with exemptions for certain things like retirement accounts and personal property and under certain amounts. His plan projects to bring in more than $1 billion in 2022, further increasing in future years. This proposal is almost guaranteed to be challenged in court as supporters and opponents of the tax continue to disagree on whether or not it would be considered an income tax. The governor also proposes additional revenue through a tax on certain health insurers.

A request by the Department of Financial Institutions to provide funding to support a diversity, equity, and inclusion financial literacy plan developed in partnership with financial institutions was also included as well as a DEI staff position at DFI to coordinate with financial institutions and local governments to help underserved populations participate in financial services.

With unprecedented utilization of the state’s unemployment insurance fund during this year’s high unemployment, as well as losses due to fraudulent activity, only some of which have yet been recovered, the governor is proposing policy and funding changes to minimize rate hikes. With employers likely receiving their initial 2021 unemployment insurance assessment rates this week the governor’s team has shared with NWCUA and other organizations their desire to avoid a massive spike in unemployment insurance rates paid by employers in 2021 that would occur under current state law requirements on how to replenish the fund.

The proposal would increase the period of time used for calculating an employer’s experience rating from the previous 4 years to 5, exclude layoffs occurring between March 22 and May 2 in future calculations of an employer’s experience rating, smooth out increases in the social tax rate between 2021 through 2025 to avoid a one-year jump from .25 to 1.22, suspend collection of the fund’s “solvency tax” until 2025, and take out a federal interest-free loan for $420 million.

A full breakdown of the governor’s proposal can be found here and of course, feel free to reach out ([email protected]) with any questions.

Posted in Advocacy on the Move, Washington Advocacy.