TruStage Releases Credit Union Trends Report

July 30, 2024

By Steven Rick, Chief Economist, TruStage

TruStage recently released its June Credit Union Trends Report which shares trends of lending volume and credit quality. Highlights of this month’s report include:

Economy

- Credit union yield on asset ratios rose to 4.84% in the first quarter of 2024, the highest since 2009 and above the 4.5% long run average.

- Over the last year, yield-on-asset ratios rose from 4.06% in Q1 2023, to 4.84% in Q1 2024.

- Expect the yield on asset ratio to rise to 5.4% by the end of the year as the Federal Reserve keeps the Fed Funds interest rate at 5.35% until the 4th quarter, and loan growth exceeds investment growth, shifting the mix of assets to higher yielding loans.

- Over the last 25 years the “credit spread” or the difference between credit union yield-on-asset ratios and the 10-year Treasury interest rate averaged around 1.25 percentage points.

Lending

- Credit union loan balances rose 0.4% in April, a little more than half the 0.7% pace reported in April 2023 and 4.5% during the last 12 months.

- Credit union loan growth has slowed significantly in 2024. Credit union total loan balances fell 0.14% in the first quarter of 2024, significantly below the 1.6% rise in the first quarter of 2023.

- New vehicle sales rose in April to a 15.8 million seasonally-adjusted annualized sales rate – up 2% from March, and 0.7% above the pace set in April 2023.

- During the last 12 months home prices rose 6.5%, due to a persistent lack of supply of homes for sale.

- Expect credit union loan balances to rise only 4% in 2024, and 5% in 2025 which will be below the long run average rate of 7.2%.

Members/Assets

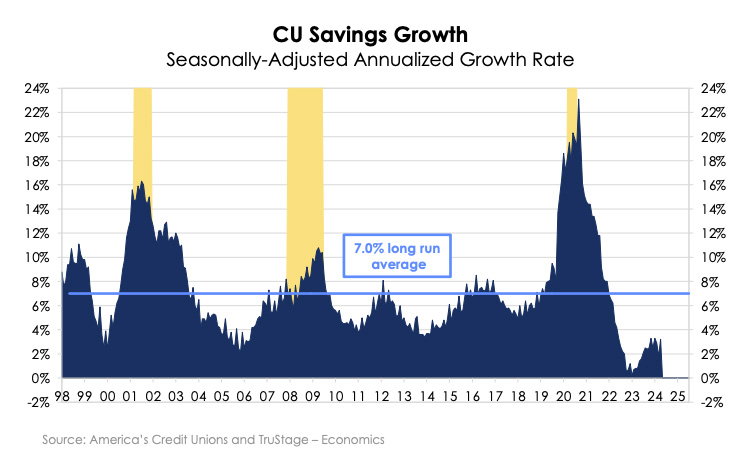

- Savings growth for the first four months of the year came in at 2.3%, above the 1.4% set last year but below the 4.1% average pace set during the last 20 years.

- Expect savings balances growth to slowly rise this year as consumers return to a more normal pace of spending and saving following the atypical spending/savings patterns experienced during the COVID-19 pandemic and aftermath.

- During the first four months of 2024, approximately 77 credit unions ceased to exist because of mergers, purchase and assumptions or liquidation.

View the full June CU Trends Report HERE.

To learn more about TruStage and the solutions they offer, connect with the GoWest Solutions Team today.

Source: June 2024, CUNA Economics & Statistics and TruStage Economics. This report on key CU indicators is based on data from TruStage E&S’s Monthly Credit Union Estimates, the Federal Reserve Board, and TruStage – Economics.

TruStage™ is the marketing name for TruStage Financial Group, Inc., its subsidiaries and affiliates. © TruStage

Posted in GoWest Solutions, Top Headlines.