Today vs. 2008 — We Won’t Repeat the Mistakes of the Past

Posted by Katy Wagnon on November 15, 2022

Mike De Vere, CEO of Zest Ai – a GoWest Solutions partner – took the time to share his insights on how his team overcame the warning signs of the 2008 recession in today’s similar market. Here’s what he shared with us:

I don’t think that I need to set the scene here because many of us understand the harsh reality of the 2008 recession. I’d also reckon that some, if not most, of us worked in the financial services industry when the recession hit.

Today’s world and economic outlook feel oddly parallel to 14 years ago. Interest rates are skyrocketing. Home prices are at historic highs. Inflation is at a high peak. And yet, we all know that the situation is more complex than what those three sentences could capture.

But I’m not here to scare you. Really, I’m not! I hope to do the opposite with the next few minutes of your time.

When speaking with leaders of credit unions across the United States, one thing remains constant — you want to do better this time, come what may.

It’s that attitude, desire, and sheer power of will that are going to make the difference in today’s economic climate…along with just a little help from your friends here at Zest AI.

The appropriate question is, “When are they?”

I think the cult classic “Back to the Future” best helps us set the scene here. Because we did it — we built a time machine (model) and booted our data science team back to the Great Recession so that we could put Zest to the test.

What was our hypothesis, you may be asking? It wasn’t the time travel piece. We wanted to know the answer to the first question you read in today’s blog: What if we could have navigated loan decisioning more sure of the risks we were taking and found more members who needed our support?

Long story short — cutting out the bit where we have to go to the store to ask for some Plutonium — we can. Zest’s time machine (model) found more good borrowers who should have received loans and also flagged more high-risk loan decisions that national scoring methods would have approved.

Explaining the Zest AI Time Machine (model)

We designed and ran an experiment to see if we could have helped our banking partners better navigate the 2008 recession and, in turn, helped people across the country get the money they needed during an incredibly harsh economic period. Specifically, we wanted to answer this question: If Zest took our AI underwriting solution from today and traveled back to a pre-Recessionary time to build a credit model, would our model have outperformed widely-used industry scores during the Great Recession?

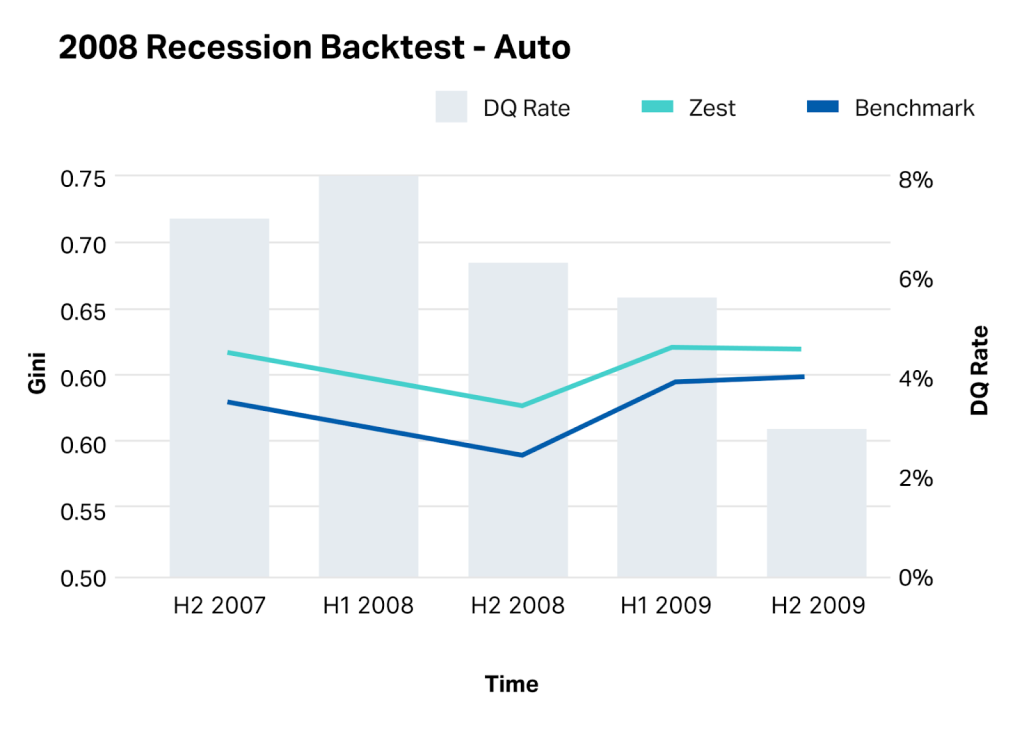

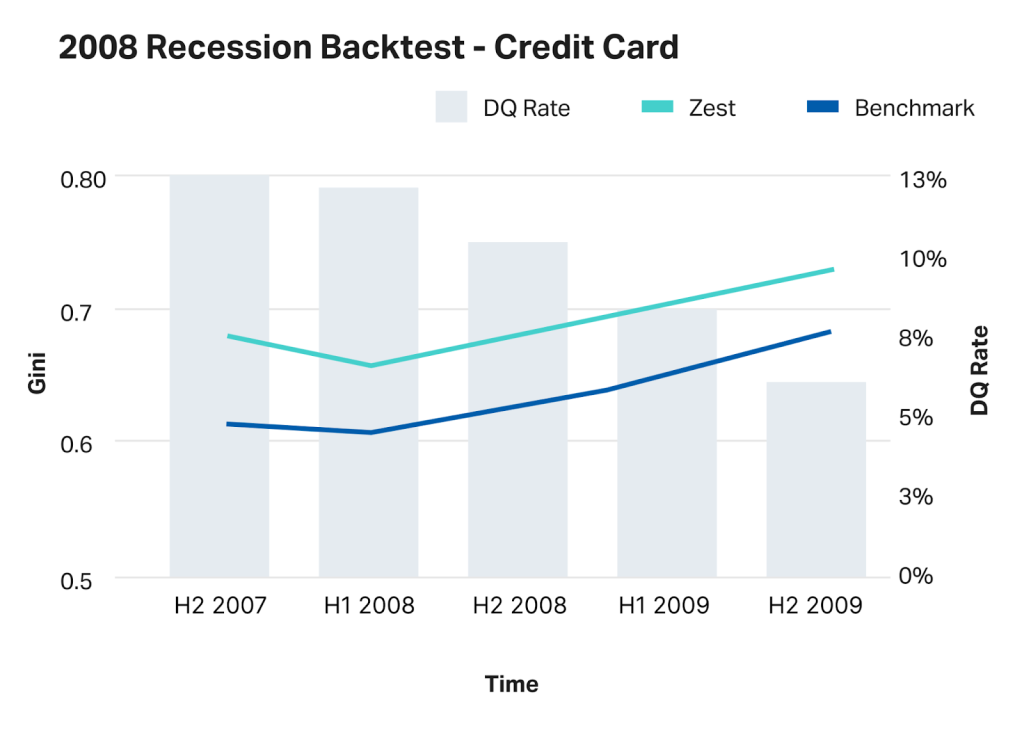

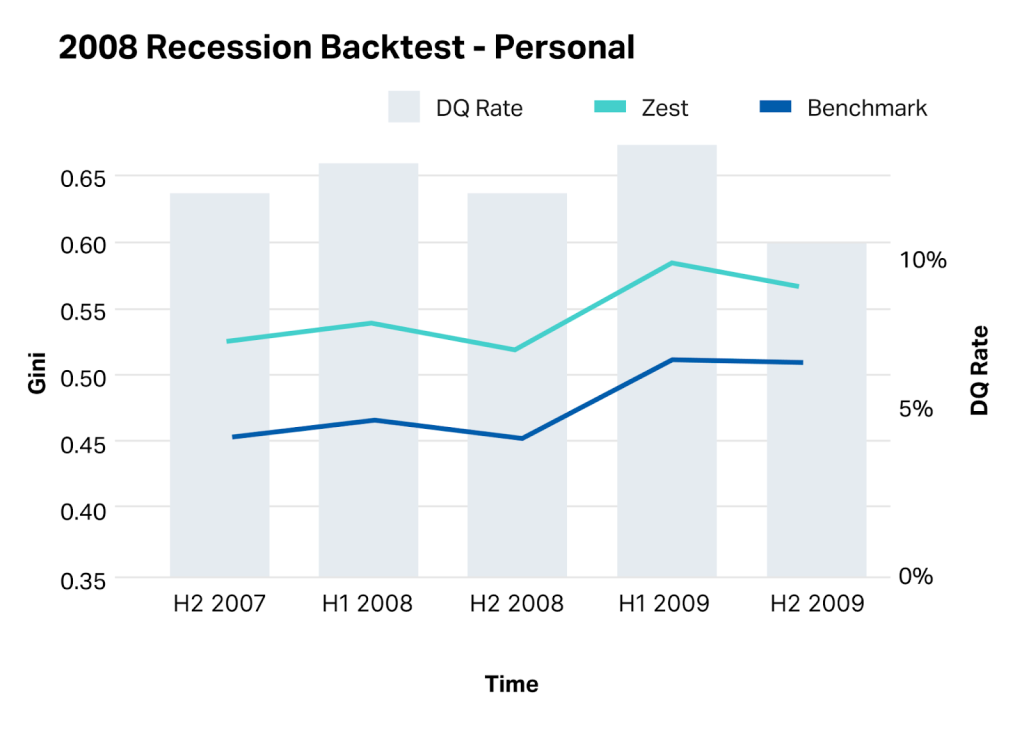

To answer this question, our model was trained with data from 2005 and 2006 and blind-tested on 2007, 2008, and 2009 data. The industry score (a.k.a. the “Benchmark”) also used the same data to compare model performance.

Model Gini was the performance metric of choice. Gini is a commonly used statistic in credit underwriting that measures how well a model can separate — or “risk-rank” — good candidates for credit from bad ones. For context, relative Gini improvements of as little as 5% often create the significant kinds of benefits that our customers regularly see today, e.g. a 25% approval rate increase with risk held constant.

The results below, plotted as lines, demonstrate that for personal loans, auto loans, and credit cards, lenders that would have selected Zest over a national credit score would have fared significantly better during the Great Recession. In addition to model-to-model performance, we also included delinquency rates that each product experienced in that time period, marking whether or not a loan became 90 days delinquent in its first 24 months (plotted as bars).

This brings us back to today, in a world where we’re looking at a changing economic landscape that is familiar. Zest has proven that we’re high performers at the best of times — we’ve increased approvals by 25% on average, with risk remaining constant while improving auto-decisioning fivefold for customers. What this study tells us, and what we wanted to be sure of, is that we also outperform in challenging situations. You’re covered. Your members are covered.

The cherry on top here is that when you have more performant models, you have safer, better, and fairer underwriting that gives your members an equitable shot at credit. These members might not have gained that credit access otherwise, and when tough times do eventually hit, you can be there to support them with what they need to make it past the hard times.

We can help fix the future by utilizing our past.

“Those who cannot remember the past are condemned to repeat it.”

– George Santayana, Spanish philosopher

So we didn’t really figure out time travel. But we did figure out a better way to make lending decisions, a way that’s safer when times are uncertain and more equitable when the world is unfair.

As much as we might want to, we cannot fix the past. If building a time machine was as easy as building a time machine model, we wouldn’t need this blog post anymore. But we can only learn from our mistakes and decide to do better the next time.

You know these loans are worth more than a three-number score because you know the person on the other side of a decision. They are your friends. Your neighbors. Your family. Your community. These people trust you with their financial futures and know you’re making every decision meticulously.

The thing we come up against the most in conversations with credit union leaders is the hesitation to trust artificial intelligence. We know that hesitation is founded on good intentions and a desire to protect your members. You are careful when choosing the right technology, the right partners, and the right moment for implementing changes. It’s a smart business move.

The ”next time” is here. Now is the time to take action. Now is the time to trust Zest’s meticulous work proving that we can help. Now is the time to decide to work with us. We want to work with you. We want to see your members succeed and your communities thrive. We’re here for them like we’re here for you.

To learn more visit Zest Ai and contact your GoWest solutions team to get started.

Posted in GoWest Solutions, Top Headlines.