Stimulus Checks Likely to Start Rolling Out Next Week

Posted by Lynn Heider on April 6, 2020

The COVID-19 crisis has credit union teams working as quickly as possible to serve their members. Part of the CARES Act passed late last month, includes Economic Impact Payments (EIP) stimulus checks to millions of households. This will put more demand on credit unions juggling an increased demand for cash, a heavy load of direct deposits, and systems to help those without direct deposit to cash or deposit their checks. The Northwest Credit Union Association’s team provides answers to the questions we’ve received.

What we have heard from the Internal Revenue Service

All payments that can be made through ACH/direct deposit will be handled similarly to tax returns.

For most cases they will transfer these over a three-week period starting late this week, or the week of April 13th for the estimated 60 million Americans who have direct deposit set up with the IRS.

For the remaining individuals, checks will likely begin to be cut by May 5th, at a rate of about five million checks a week. Some eligible consumers may not receive their checks until August. The government is sending the checks based on income, with the lowest income individuals receiving checks first.

What we have heard from the Federal Reserve

Treasury and the Federal Reserve held a webinar this week during which the disbursement of EIPs was discussed. It was announced that federal beneficiaries with Direct Express debit cards will receive payments to those cards. The EIPs will be subject to debt collection actions similar to tax refunds.

CARES Direct Cash Benefits for Individuals

Here is who qualifies for stimulus checks:

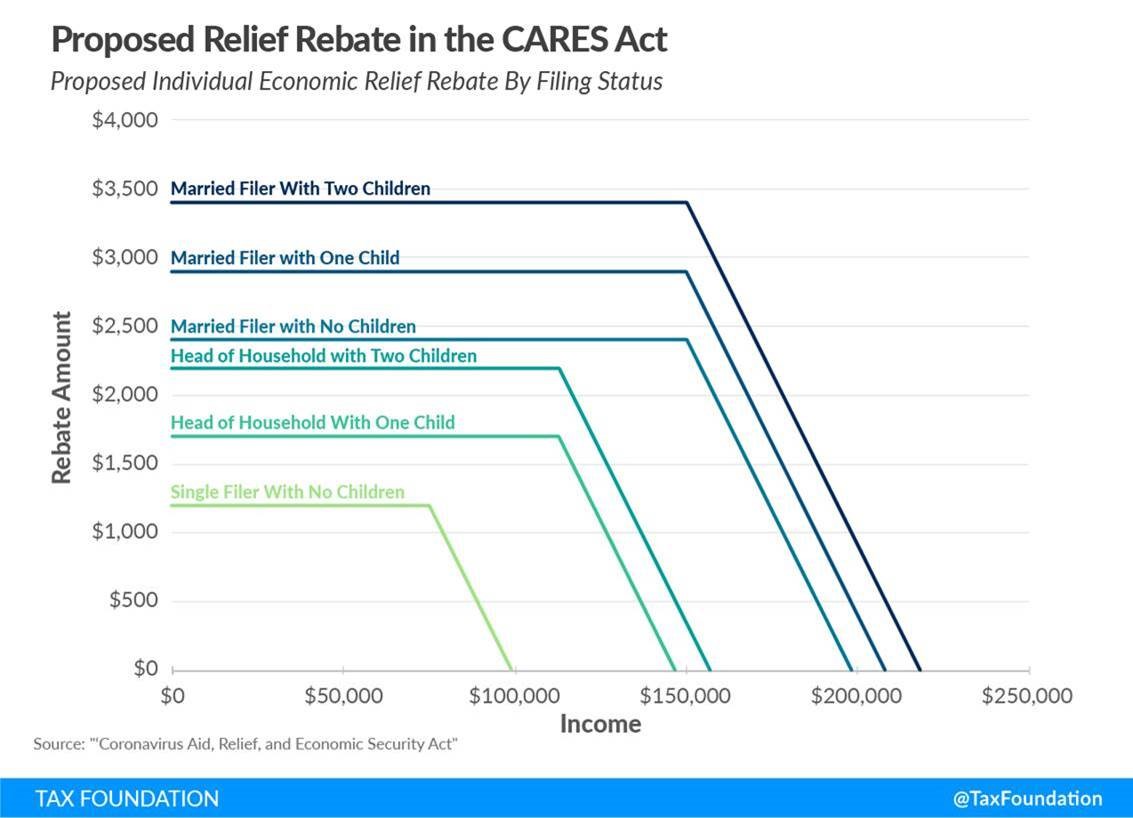

Under the CARES Act, individuals with income of up to $75,000, or married couples earning $150,000 annually will receive payments of $1,200 with an additional $500 payment per minor child. The payments decrease ratably and stop altogether for single workers making more than $99,000 ($198,000 for married workers and $218,000 for a family of four). These payments will be issued by the IRS via direct deposit and will be based on 2019 or 2018 tax returns or on the 2019 Social Security statements.

For consumers who qualify but have not filed a tax return in 2018 or 2019, and do not receive Social Security benefits, the IRS recommends filing a 2018 return to receive payment. If the IRS does not have bank account information for such consumers, they should look for a letter from the IRS, outlining how to receive payment.

Consumers who receive Social Security, retirement, or other social safety net benefits, may still qualify for direct payments. The IRS is making final determinations about these details now.

Posted in Advocacy on the Move.