Frontier Credit Union Makes an Impact on Idaho Small Businesses

Posted by Alyse Knudsen on June 3, 2024

In July 2022, Frontier Credit Union (formerly East Idaho Credit Union) began a lending program specifically for start-up businesses after seeing that the economic challenges from the pandemic were still weighing heavily on their local small business community. Since then, with the help of a grant from the GoWest Foundation, Frontier has helped 12 local start-ups with their quest for funding.

Frontier’s Start-up Loan program was designed to help businesses begin a borrowing relationship with a trusted financial institution during a vulnerable stage of growth when funding is not typically available. It allows businesses under two years of age, to apply for a loan of up to $3,000 with a fixed rate of 9.99% APR, with a requirement to pay it back within 12 months. The program also encourages the borrower to attend two, 2-hour educational courses – one from Frontier’s Chief Lending Officer about business finances and one from Frontier’s Chief Marketing Officer on effective marketing.

To qualify, Start-up Loan participants must be in business for at least one month and have at least one sale. At the end of the 12-month loan term businesses are given the option to convert the Start-up Loan into a line of credit to help support the business in leveraging themselves as they grow.

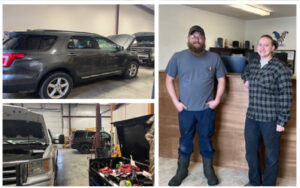

Fix It Rite Truck & Auto, a veteran-owned and family-operated auto mechanic shop in rural Rigby, Idaho, was one of the Start-up Loan recipients. They had major overhead, equipment, and supply costs as they prepared to open their doors, but their biggest concern was the ability to pay their mechanic while they waited for customers to pay them.

Fix It Rite came to Frontier for a line of credit but didn’t have the two years of taxes necessary for a traditional loan, a limitation they had also encountered at other financial institutions. They were then told about Frontier’s Start-up Loan that could assist them through their operation challenge of offering regular paydays to their mechanic during slow months. Frontier qualified them for a $2,500 loan which gave them the boost they needed during their downtimes. “It [the loan] was everything for us,” shared Fix It Rite Truck & Auto’s owner, Austin Barnes. “It gave us peace of mind at a time when we needed just a little help to fill in the gaps, and we are already looking at expanding that line of credit to leverage us to do even more with our business. I couldn’t in good conscience get one of those online loans!”

Fix It Rite came to Frontier for a line of credit but didn’t have the two years of taxes necessary for a traditional loan, a limitation they had also encountered at other financial institutions. They were then told about Frontier’s Start-up Loan that could assist them through their operation challenge of offering regular paydays to their mechanic during slow months. Frontier qualified them for a $2,500 loan which gave them the boost they needed during their downtimes. “It [the loan] was everything for us,” shared Fix It Rite Truck & Auto’s owner, Austin Barnes. “It gave us peace of mind at a time when we needed just a little help to fill in the gaps, and we are already looking at expanding that line of credit to leverage us to do even more with our business. I couldn’t in good conscience get one of those online loans!”

To learn more about Frontier Credit Union’s Start-up Loan program, visit here.

The GoWest Foundation partnered with Frontier by providing a grant to help mitigate the risk of loan loss and assist with program implementation expenses. The foundation is proud to support the efforts of credit unions like Frontier to help better the financial lives of members in their communities through grants and partnerships. To learn more about how GoWest can support your efforts, email [email protected].

Posted in Community Impact, GoWest Foundation, Idaho, Top Headlines.